Basic payroll calculations

Developing a Basic In-House Training Program. And professional-grade payroll software will help you keep track of all tax-related calculations.

Access Database For Small Business Payroll Software And Tax With Regard To Small Business Access Database Template Access Database Payroll Software Payroll

In simplest terms the basic formula for net pay works like this.

. W-2 W-3 940Schedule A 941Schedule B 944 945a 943943a 1099-MISC and 1096. Manual systems are not equipped with mechanisms to detect errors. Payroll Processing Calendar Year End 2017.

The cost of QuickBooks Standard Payroll is also very reasonable for small business owners at just 20 plus 2 per employee per month. If you need software to guide you through basic tax preparation HR Block is here to help. Deleting Pending File Transactions.

Please check with your employer or benefits provider as they. For state forms not yet supported we provide a State Tax Summary report with all the payroll data you need. These calculators include macros for printing worksheets adjusting display size and quitting or exiting the calculator.

SurePayroll offers a range of convenient features including auto-payroll same-day payroll and a mobile app. Their job involves handling large sums of money on a daily basis to ensure that employees are paid accurately and on time. You dont have to pay a professional or purchase a program.

Calculate paychecks and taxes Get automatic tax calculations on every paycheck. Enhanced Payroll includes many state forms. While not the best fit for larger businesses QuickBooks Online Standard Payroll does cover all the basic functions that small businesses require to effectively run payroll.

Starting at 6. Hires and total separations also change little 08262022 From 2019 to 2021 36 million workers displaced from jobs they held for at least 3 years All Releases. Recording your employees details.

New businesses will find it appealing as it doesnt require expensive subscription fees. The basic provision is that the first salary bracket 0791month 2013 has its normal benefit percentage of 90 reduced to 4090 see Social Security for the exact percentage. Enhanced Payroll completes these federal payroll tax forms for you.

Project management is the process of leading the work of a team to achieve all project goals within the given constraints. In-House Manual Payroll System. Payroll jobs up in 99 08302022 July job openings change little.

When you manually run payroll you have full control over your payroll. Find out why at our blog. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

VRS Hybrid Opt-in for Plan 1 State Employees. Example 10000 - 6000 10 or 100 Reserve Ratio 40000. Payroll Developing Team based on New Tax Rates 2021 Simple Basic to NetSalary Calculator Basic Salary.

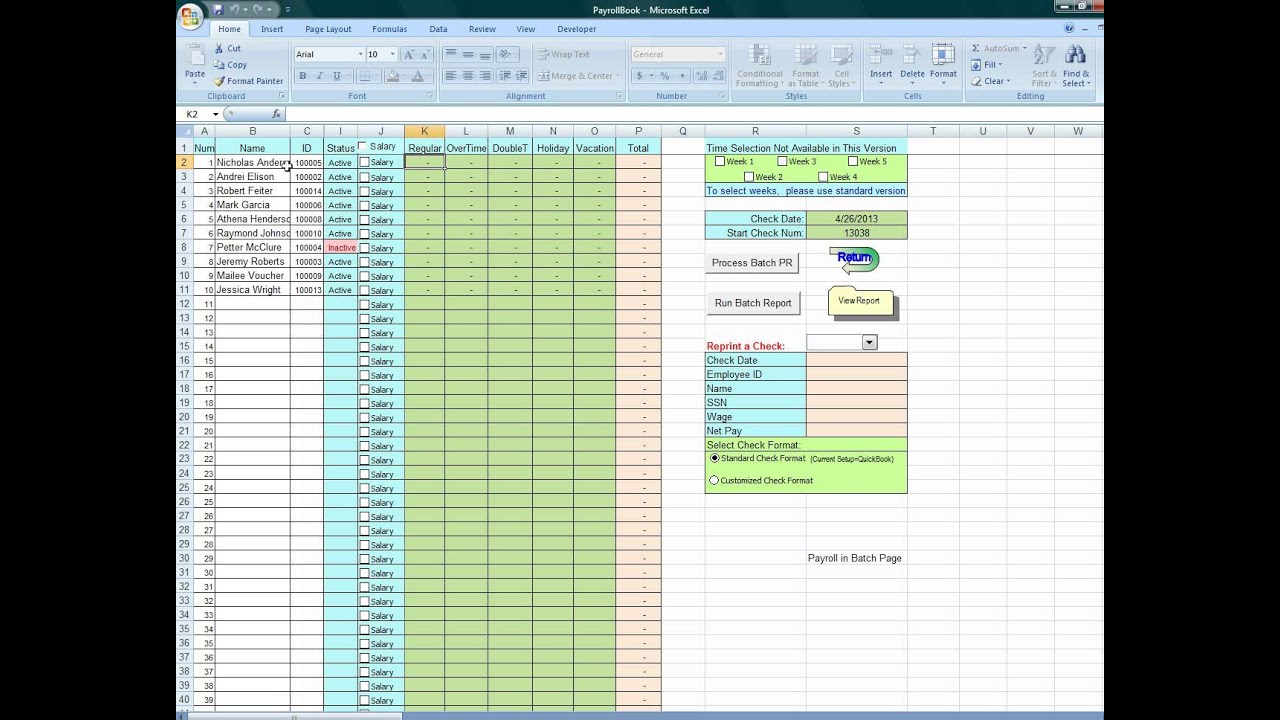

Though there are other tools for basic calculations but standoff of using excel is its flexibility and the perception for the viewer it gives. After you enter employee information along with their earnings and deductions ExcelPayroll can run the payroll calculations from there. From making complex calculations to processing payments within strict deadlines this is a challenging demanding and fulfilling role.

Payroll unemployment government benefits and other direct deposit funds are available on effective date of settlement with provider. This information is usually described in project documentation created at the beginning of the development processThe primary constraints are scope time and budget. By CBO calculations the household incomes in the first quintile and second.

You know when and how your payroll is completed. Contact your payroll coordinator before submitting payroll as there may be special forms required for your project particularly if working with minors or non-union employees but in most cases the standard payroll paperwork includes-W4 Form-I9 Form-Employee timecard or Union time sheet-Copies of employment contracts-Check authorization forms. TimeTrex offers its most basic payroll features for free under.

Well monitor and update federal and state taxes so you dont have to. The Basic Formula for Net Pay. Paid plans are slightly more affordable than the likes of QuickBooks Payroll although it doesnt have as rich a feature profile.

Issues Requiring Special Attention. Think of these basic steps as a roadmap for your payroll process. See Accurate Calculations Guarantee for details.

The payroll ceiling is now adjusted for inflation. At any time you can activate to start your billing cycle and gain access to items like tax filing and approving payrolls beyond the current month. But doing payroll yourself likely means you dont have someone to check your calculations.

08312022 July jobless rates down over the year in 383 of 389 metro areas. Learn how to calculate and report deductions. Timely payment also ensures full credit against the employers Federal Unemployment Tax.

Fast unlimited payroll runs QuickBooks Online Payroll lets you view and approve employee hours and run payroll in less than 5 minutes. Automated tax and forms Federal and state payroll taxesincluding year-end. For security reasons these macros are often disabled by default settings on the users computer.

Average Taxable Payroll Prior 3 years Reserve Ratio. If you decide to run payroll yourself you need payroll software to report to HM Revenue and Customs HMRCThe software will help you with tasks like. It may appear like something is wrong with the online payroll tax calculations.

For instance we can add two numbers in the calculator as well but the numbers mentioned in the excel sheet can be entered in two cells and used for other functions as well subtraction division etc. See below for a summary of the relevant exemption periods and requirements for a recently confirmed case. Every Business Needs to Process Payroll.

The law requires that payroll taxes must be withheld from an employees paycheck. Users can also print checks and tax forms see workers compensation reports and record payroll deductions such as 401k contributions. However manual payroll calculations might result in incorrect payroll processing.

If an employer or operator becomes aware that a worker attended the workplace in the 48 hours prior to becoming symptomatic the employer must follow mandatory steps including advising other workers at the worksite to. If you have payroll experience and need a quick refresher this first set of steps can be a quick. Payroll calculations might be handled manually by some new companies.

This lets us find the most appropriate writer for any type of assignment. Net Salary Simple Net to Gross Salary Calculator Net Salary. Upon processing your first payroll you can use Wave Payroll for up to 30 days commitment-free.

Doing payroll by hand is the least expensive payroll option. Gross Salary Basic Salary Calculate Gross Salary. A payroll administrator like accountants hold a crucial role within every organisation.

Lift the payroll ceiling. This is a factor used in reserve ratio calculations. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Software needs.

Basic payroll processing steps. The secondary challenge is to optimize the allocation of necessary inputs and apply. Changes to SUI Gross and SUI Taxable Calculations.

Excel Payroll Calculator

Payslip Template For Excel And Google Sheets Templates Accounting Basics Excel Templates

What Is Annual Income How To Calculate Your Salary

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Shortcuts

Salary Slip Templates 20 Ms Word Excel Formats Samples Forms Payroll Template Cv Template Word Word Template

How To Prepare Payroll In Excel This Wikihow Teaches You How To Calculate Payroll For Your Employees In Microsoft Excel Creating A Payro Salary Excel Payroll

Payroll Time Conversion Chart Payroll Calculator Conversion Chart

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

How To Calculate Your Net Salary Using Excel Salary Excel Ads

Self Employment Ledger Forms Beautiful Printable Payroll Ledger Payroll Payroll Template Bookkeeping Templates

9 Ready To Use Salary Slip Excel Templates Exceldatapro Excel Templates Payroll Template Salary

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Worksheet Template

Use This Template To Calculate And Record Your Employee Payroll Three Worksheets Are Included One For Employee Payroll Bookkeeping Templates Payroll Template

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Formula

Using Excel To Process Payroll Dyi Excel Excel Calendar Template Payroll